I have found that a lot of life advice comes from the stock market. Watching costs, trying to beat the market/life, etc. Let go, you don’t plant a seed and dig it up the next day to see how it’s doing. Stop messing with life, accept it, invest and let go.

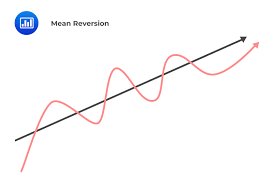

Anyways, reversion to the mean is a statistical anomaly that a price will converge to the average over time (generally). How similar is that to life? We have good days and bad days, highs and lows, peaks and valleys days of heaven and days of hell.

So, like the market and investing (at least for a bogglehead like me) the best way to beat the market is not trying to. Why look for a needle in the haystack when you can buy the hay stack? Don’t worry about your highs and lows if your average/life is on an upwards trajectory. Sit back and invest in the index fund of life.